By enacting the largest tax cut since the Reagan administration, the heart of which is cutting the corporate rate from 35 to 21 percent, Republicans have boldly bet the farm.

They have rewritten America's tax code to reflect their belief that cutting taxes on the private sector will produce the prosperity they have promised. If it happens, the GOP will reap the rewards, if not by 2018, then in 2020.

Democrats, as the Party of Government, egalitarian and neo-socialist, have come to see their role as redistributing wealth from those who have too much—to those who have too little. For, as men (and women) are born unequal in ambition, ability, talent, energy, personality and drive, free markets must inevitably produce an inequality of results.

The mission of Democrats is to reduce those inequalities. And as the very rich are also the very few, in a one-man, one-vote democracy the Democratic Party will always have a following.

Winston Churchill called this the philosophy of failure and the gospel of envy.

Republicans see themselves as the party of free enterprise, of the private not the public sector. They believe that alleviating the burden of regulation and taxation on business will unleash that sector, growing the economy and producing broader prosperity.

By how they voted Wednesday, Republicans yet believe in "supply-side" economics. In the early '80s, this was derided as "voodoo economics" and "trickle-down" economics, and pungently disparaged by John Kenneth Galbraith as an economic philosophy rooted in the belief that, if you wish to feed the sparrows, you must first feed the horses.

The problem for Democrats is that Reaganomics worked, and is seen historically to have been successful. In 1984, growth was near 6 percent and Reagan rode to a 49-state landslide over Fritz Mondale who, at his San Francisco convention, had declared he would raise taxes.

Thus the importance of what happened Tuesday and Wednesday on Capitol Hill should not be underestimated.

On their legislative agenda, Republicans broke out of a slump. Though they got not a single Democratic vote in either chamber, they showed they can govern alone. On the lead item on the GOP-Trump agenda—taxes—they delivered. They shifted policy dramatically toward Republican philosophy. They wagered their future on their convictions. And the splenetic rage among Democrat elites suggests that they know they have suffered a defeat difficult to reverse.

Moreover, though the bill that came out of Congress is unpopular, the nation will not vote on Trumpian management of the economy until November 2018, after the early returns from the tax cut have come in.

And the Democratic Party has also been put into a tight box.

As Democrats have denounced the tax bill for exploding the debt by $1.5 trillion, how do they propose to pay for all the free stuff, including free tuition and infrastructure, that they will have on offer?

There are only two options: borrowing and growing the national debt themselves or raising taxes, as Mondale promised to do.

Another problem for Democrats is the new $10,000 limit on the tax deduction for state and local income and property taxes.

In blue states like Oregon, Minnesota, New Jersey, Vermont, Hawaii, the top state income tax rate is 8 to 10 percent. In Jerry Brown's California and Andrew Cuomo's New York, it hits 13 percent—before adding property taxes on homes and condos in Manhattan and second homes out on Long Island.

Virtually eliminating state and local tax deductions is going to cause some of the rich to consider relocating to low-tax or no-tax red states in the Sun Belt like Florida. And it is going to put pressure on blue state pols to cease adding to the state and local tax burdens that Uncle Sam is not longer helping to carry.

Stepping back from all the Sturm und Drang of 2017, the Trump-Republican record of achievement, of meeting commitments made in the campaign of 2017, is not unimpressive.

The largest tax cuts in decades. Elevation of Neil Gorsuch to the Antonin Scalia seat on the Supreme Court. A record number of new U.S. appellate court judges approved by the Senate. The U.S. is out of the Paris climate accord and out of the Trans-Pacific Partnership.

NAFTA is being renegotiated. Alaska's Arctic National Wildlife Refuge will be open for drilling. The U.S. is at full employment, with minority unemployment near record lows. The stock market has consistently broken records, with the Dow having added 5,000 points. The Obamacare individual mandate tax is gone. Obama-era regulations have been cut and some eliminated.

And one year deeper into Russiagate, and still there is no proven collusion between candidate Trump and the Russians.

Indeed, the Robert Mueller investigators appear now to be coming under as much scrutiny and suspicion for how they behaved during the election and transition as Vladimir Putin and the Russians.

Patrick J. Buchanan needs no introduction to VDARE.COM readers; his books State of Emergency: The Third World Invasion and Conquest of America, and Suicide of a Superpower: Will America Survive to 2025? are available from Amazon.com. Patrick J. Buchanan is the author of “The Greatest Comeback: How Richard Nixon Rose From Defeat to Create the New Majority.

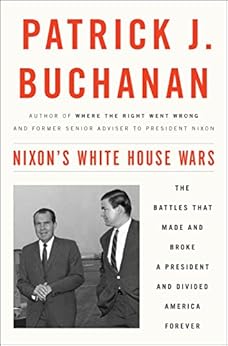

His latest book, published May 9, is “Nixon’s White House Wars: The Battles That Made and Broke a President and Divided America Forever.”

See Peter Brimelow’s review: “Wheel And Fight”—Pat Buchanan’s Nixon Book Provides Road Map For Trump.