It’s always nice to see serious thought given to dealing with the automated future, when millions of jobs are forecast to be lost. The employment economy is outstanding today, but robots will be chipping away at the number of workers as the cost of smart machines decreases in coming years.

A fundamental problem with the automated future is that manufacturing will be going great but there won’t be enough employed shoppers to purchase the abundance of material items in stores to maintain the economy.

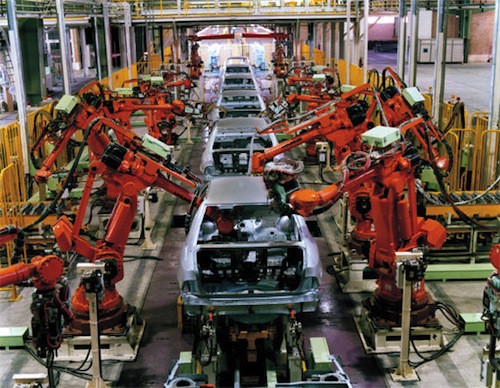

Sometimes it can be hard to spot a human worker on a modern manufacturing floor today.

One suggestion has been to tax the robots, an idea which Microsoft founder Bill Gates supported in a 2017 interview:

BILL GATES: Certainly there will be taxes that relate to automation. Right now, the human worker who does, say, $50,000 worth of work in a factory, that income is taxed and you get income tax, social security tax, all those things. If a robot comes in to do the same thing, you’d think that we’d tax the robot at a similar level.

Another strategy to mitigate the effect of automation on the economy would be to end immigration and stop admitting millions of unskilled persons who will be even more unemployable than they are now, because

Automation Makes Immigration Obsolete

That includes the bloated family-based variety of immigration and all the Victim types like the U Visa for foreign crime victims and T Visa for non-American victims of human trafficking. We can also get rid of the Diversity Visa since America is forecast to be majority minority by about 2045.

When big automation hits in a few years, the whole immigration edifice will be understood by observant people as an unhelpful remnant of the previous century and a total drag on the challenging times ahead.

Here’s a review of expert opinion about how soon the axe will fall: Oxford researchers forecast in 2013 that nearly half of American jobs were vulnerable to machine or software replacement within 20 years. Rice University computer scientist Moshe Vardi believes that in 30 years humans will become largely obsolete, and world joblessness will reach 50 percent. The Gartner tech advising company believes that one-third of jobs will be done by machines by 2025. The consultancy firm PwC published a report last year that forecast robots could take 38 percent of US jobs by 2030. In November 2017, the McKinsey Global Institute reported that automation “could displace up to 800 million workers — 30 percent of the global workforce — by 2030.” Forrester Research estimates that robots and artificial intelligence could eliminate nearly 25 million jobs in the United States over the next decade, but it should create nearly 15 million positions, resulting in a loss of 10 million US jobs. Kai-Fu Lee, the venture capitalist and author of AI Superpowers: China, Silicon Valley, and the New World Order, forecast on CBS’ Sixty Minutes about automation and artificial intelligence: “in 15 years, that’s going to displace about 40 percent of the jobs in the world.” A February 2018 paper from Bain & Company, Labor 2030, predicted, “By the end of the 2020s, automation may eliminate 20% to 25% of current jobs.”

So the robot taxation strategy deserves the attention of concerned citizens — and oblivious Washington.

The idea of a ‘robot tax’ is gaining steam as a way of dealing with automation that’s killing jobs, Business Insider, January 9, 2020

● The idea of taxing robots has gained steam in recent years as a possible way of curbing the spread of automation and better protecting American workers.

● A decent chunk of jobs are at risk of being automated in the US.

● Bill Gates called for the tax in 2017 and New York City Mayor Bill de Blasio laid out a plan for it during his short 2020 presidential run.

● But a so-called “robot tax” faces significant hurdles in design and implementation.

“Tax the rich” is now a common refrain in American politics. But could “tax the robots” ever become popular as well?

The idea of a so-called “robot tax” has gained steam in recent years, particularly after a barrage of studies that suggested automation threatens the future of a substantial chunk of jobs in the United States. The risk is especially pronounced within manufacturing, and increasingly those in white-collar positions.

One estimate from researchers at the Brookings Institution found that one in four US jobs are at high risk of being automated.

Bill Gates famously called for the tax back in 2017. New York City Mayor Bill de Blasio also laid out the framework for a type of robot taxation during his brief presidential run, calling for companies to pay five years’ of payroll taxes for every job automated.

Both believed a robot tax could curb the spread of automation and add a layer of protection for American workers.

Orly Mazur, a tax law professor at Southern Methodist University who has researched the robot tax, says it could be used to stymie automation, though only temporarily.

“I believe an appropriately designed robot tax can hinder the progress of the development of automation that kills jobs,” Mazur told Business Insider in an email, though noting she believes it’s the wrong approach to deal with automation.

Such a tax could also conceivably create another source of federal revenue in an economy governed by more machines and fewer workers — reducing the possible disruption to the funding structures of Social Security and Medicare, which rely on payroll taxes paid by every worker and to help people find or train for new jobs. (Continues)