I want to demur from one item in my friend and VDARE.com colleague Edwin Rubenstein's May 20th piece, Amnesty And The Deficit—Obama’s Orwellian Inversion. He wrote:

It might reduce the so-called unified deficit, which includes the “off budget” item Social Security, because immigrants initially pay into Social Security and are generally (not always) too young to receive benefits. But that’s not the same thing—Social Security payments are supposed to be held in trust.

That passage at the end about the Social Security surpluses being "held in trust" is the clinker, and I expect Ed knows better but didn't want to get diverted from his main points.

We routinely encounter claims that "Congress stole the money from the Social Security trust fund" and that things now would be peachy if Congress hadn't done that, or if they — somehow — paid it back. But actually, as some book I read in the mid-1990s put it, "The best way to think about the 'trust fund' is to not think about it at all."

Why? Economics columnist Bruce Bartlett recently gave a decent, succinct explanation:

On Friday, the trustees of the Social Security and Medicare systems issued their annual reports for 2011. Commentary on these reports always tends to dwell on the date when their trust funds become exhausted; in the case of Social Security it is 2036 and for Medicare it is 2024. But in truth, these figures are virtually devoid of meaning.

Benefits are not paid out of a trust fund filled with income-producing assets, like a private pension fund; benefits are paid out of tax revenues. The trust funds are merely accounting devices best thought of as budget authority. As the trust funds draw down their assets, general revenues — that is, tax revenues besides the payroll taxes earmarked for these programs — are injected into the trust funds to redeem bonds that had previously been placed there during years when revenue from the payroll tax exceeded costs.

Bartlett doesn't say it, but Social Security's cash flow (i.e. FICA payroll taxes collected minus disbursements to Social Security recipients [primarily retirees]) turned negative in 2010 and projections show it remaining negative for all years to come. So the "trust fund" is currently being drawn down, which really means that the cash-flow deficit is being made up by general revenues taken from the U.S. Treasury.

(And when the formal "trust fund" is formally exhausted in 2036, or whatever, that doesn't mean the end of Social Security. It just means that, absent legislative changes, those disbursements in subsequent years will be limited to the FICA collections in those same years. The projected result is that recipients in those years will receive about 80% of what they're formally entitled to, given Social Security's payout rules today. All this assumes that the United States will still be a going concern in 2036, something I wouldn't count on.)

There are also those who say that the "stealing" from the "trust fund" started in the last couple of decades or, alternately, was cooked up by Lyndon Johnson. But, no, the use of Social Security's annual surpluses in the general operations of the federal government was part of Social Security's (fundamentally flawed) design, right from the beginning.

If you doubt this, you might be sobered up by a few paragraphs out of a monograph published in 1950 by the left-leaning Brookings Institution, The Cost and Financing of Social Security, by Lewis Meriam and Karl Schlotterbeck, from page 155:

The establishment of the Trust Fund has given an aura of soundness and solvency to the OASI [Old-Age and Survivors Insurance] system. Many believe that this reserve fund "earns" income in the same sense as do private insurance reserves; that, if need be, all claims could be met by liquidation of the reserves; and that an individual, with his final payment of OASI taxes, will have paid in full for his retirement benefits.

The operation of the OASI Trust Fund is NOT [emphasis in original] similar in character to that of a private insurance company. Private insurance reserves (...) are usually invested in projects that directly participate in or promote the production of goods and services. These investments are procreative in character and thus "earn" income. Furthermore, they are assets of the insurance company reserve, but they are liabilities of OTHER [emphasis in original] enterprises. The OASI Trust Fund is invested in federal government securities. Since the money is used by the government in meeting its regular expenditure requirements, no real reserve is created. The obligations of the government (liabilities) deposited in a trust account do not represent assets; they merely record future obligations which can be fulfilled only through the levy of future taxes upon the economy in general. The Trust Fund is thus a fiction — serving only to confuse.

The explanation of the failure to establish trust fund assets analogous to those provided by private insurance companies is presumably that the sums ultimately involved are so stupendous that available investment securities of productive enterprises would not be adequate for the purpose. The deposit of its own liabilities in a so-called reserve fund thus appeared as a happy solution to the problem.

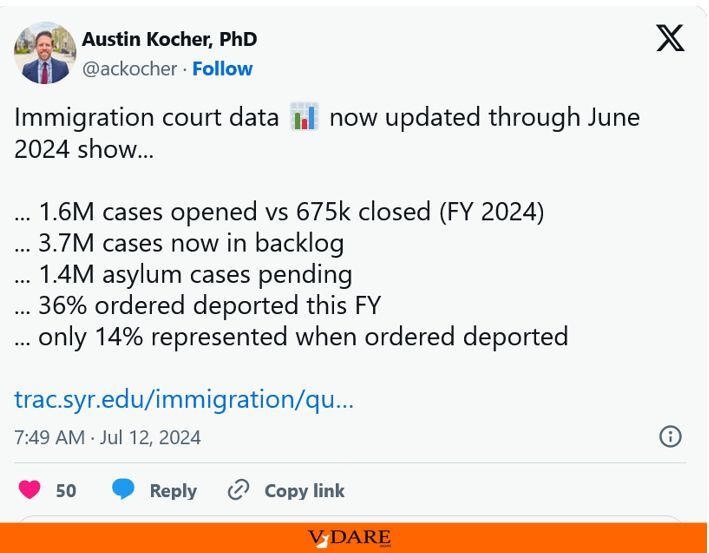

There is an immigration connection in all this. Or, actually, the connection is that frequent assertions about amnesty for illegal aliens and/or increases in legal immigration rescuing Social Security for the Baby Boomers are wrong.

Ed Rubenstein touched on this in his article cited above. And the assertions are torpedoed in greater detail by Steve Camarota in his Center for Immigration Studies backgrounder Immigration in an Aging Society: Workers, Birth Rates, and Social Security [PDF] and by the late economist John Attarian in his monograph Immigration: Wrong Answer for Social Security, published in 2003 by the American Immigration Control Foundation (see here; scroll down).

I'll close by quoting a paragraph from the executive summary of Attarian's paper:

Peter Francese of American Demographics maintained that Social Security's problems could be solved if we admitted enough immigrants to keep the ratio of taxpayers to beneficiaries at its current level. It turns out, however, that following this prescription would result in an immigrant flood, with America admitting up to five or six million adult immigrants annually as the Baby Boomers retire. Moreover, immigrants get old, too, and supporting this huge population of immigrant taxpayers when they become Social Security beneficiaries would require another massive wave of immigration. All in all, we would have to more than double our labor force by adding 183.6 million immigrants and their adult children by 2080. That does not take into account elderly immigrants and minor children who, of course, would also arrive.